According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, the India smartphone market experienced a mix of shifts and growth in the first half of 2023. The report shows that the market shipped 64 million devices during this period, a 10% decrease from the same period last year.

The market displayed a contradictory trend in the second quarter of 2023 (2Q23). While it increased by 10% over the previous quarter, it decreased by 3% year-over-year (YoY), accounting for a total of 34 million units shipped. In anticipation of the upcoming festive season in the latter half of the year, market players, including vendors and channels, focused their efforts on inventory clearance, providing consumers with a variety of discounts, special schemes and price reductions.

The average selling price (ASP) of smartphones was one notable characteristic observed in market dynamics. After several quarters of ascension, the ASP fell by 8% quarter on quarter (QoQ), but still increased by 13% YoY, peaking at $241 in 2Q23. The share of cellphones priced under $200 fell from 70% to 65% in comparison to the previous year, representing an 11% drop YoY. In contrast, the mid-range category ($200<$400) maintained its 22% market share, while the mid-to-high-end segment ($400<$600) increased 34% YoY, accounting for 5% of the market. The premium segment ($600+) grew the most rapidly, increasing by 75% YoY to capture 9% of the market.

“Consumers are opting for premium offerings, driven by easy and affordable financing options. IDC expects this growth momentum to continue in the upcoming months in 2023,” said Upasana Joshi, research manager, client devices, IDC India.

In the second quarter of 2023, a total of 17 million 5G smartphones were shipped, with an ASP of $366, representing a 3% YoY decrease. Samsung, vivo and OnePlus were among the industry leaders in the 5G sector, with a combined market share of 54%. Apple's iPhone 13 and OnePlus' Nord CE3 Lite were two notable 5G models with significant shipment numbers.

The distribution channels also underwent shifts in this dynamic landscape. Shipments via the online channel decreased by 15% YoY, while the offline route increased by 11%, claiming a 54% share. Notably, the drop in online shipments was attributed to firms such as Xiaomi and realme, which rely heavily on online sales.

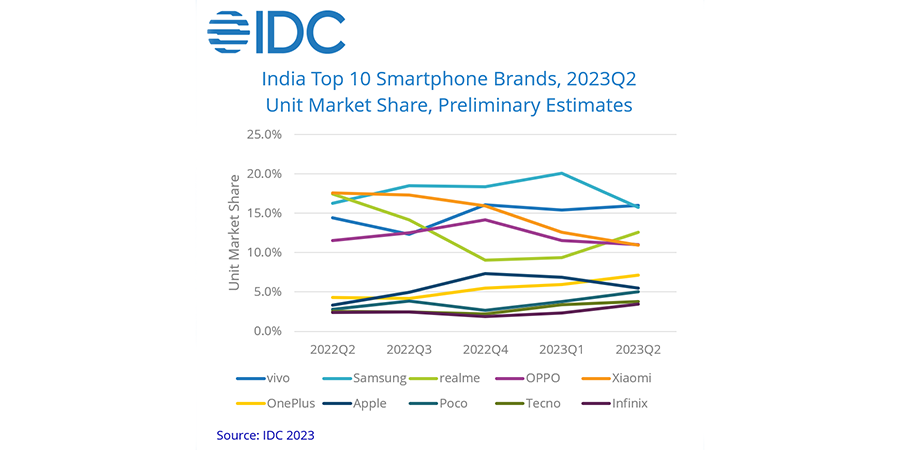

Apple emerged as a major contender, with a 61% YoY increase and the highest ASP of $929. OnePlus had 61% growth, despite a 14% YoY decline in its ASP, which ended out at $346. POCO, with its low-cost C series models, has the highest growth rate among the top 10 brands. In terms of market leadership, vivo (excluding iQOO) took the lead, propelled by its V series devices, and was closely followed by Samsung, which focused on increasing its higher-end portfolio.

As the festive season approaches, industry experts predict that brands will increase consumer demand through low-cost 5G launches, pre-booking incentives, loyalty/upgrade programs and festive discounts. However, given the current landscape, Navkendar Singh, AVP - devices research at IDC, expressed reservations about the viability of generating high double-digit growth in the coming months, saying, “The market requires strong double-digit growth in the next few months to see annual growth in 2023, which looks unlikely as of now.”