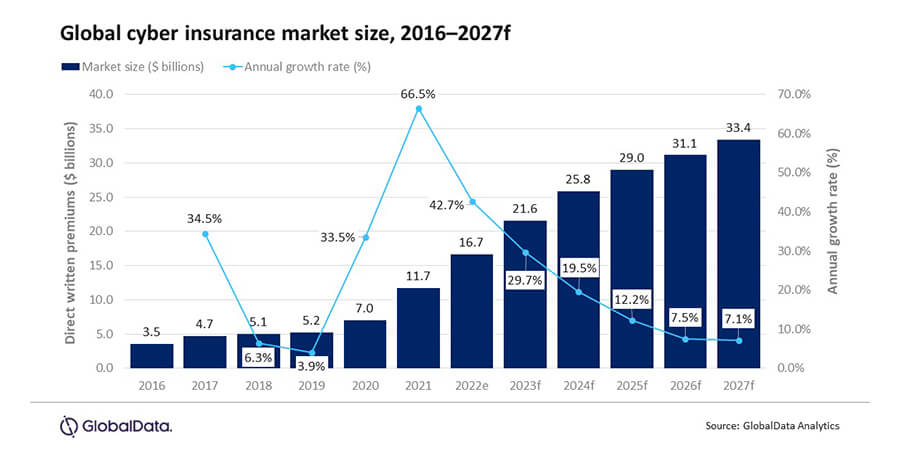

In 2020 and 2021, the market for cyber insurance saw enormous growth, mostly as a result of sharply increased premiums. Insurers raised premiums as a result of the rise in the frequency and severity of cyberattacks as well as the widespread adoption of remote working following the epidemic. In light of this, a top data and analytics company, GlobalData, predicts that the worldwide cyber insurance market will increase from US$16.7 billion in direct written premiums (DWP) in 2022 to US$33.4 billion in 2027.

According to GlobalData's most recent study, "Thematic Intelligence: Cyber Insurance 2023," DWP in the market expanded substantially in 2021 (66.5%) and 2022 (42.7%). This was true despite declining demand (the result of rapid increases in premium prices).

“As premiums gradually soften going into the second half of 2023 and beyond and as economic conditions become less burdensome on businesses, demand for cyber insurance should grow going forward,” said Insurance Analyst Benjamin Hatton of GlobalData.

He further explained that pricing will soon be held in check by increased cybersecurity, declining ransom demand tendencies, war exclusions and a more competitive insurance market. This is anticipated to gradually promote increased adoption of policies in both private and public settings, which should result in a consistently high market growth rate over the timeframe.

Following the pandemic, global cyber threats have continued to rise for businesses, and many SMEs in the UK have noticed an increase in their own cyber dangers. Nearly 50% of medium-sized businesses reported that their cyber risk had, to some extent, increased since the commencement of COVID-19.

“The tough economic climate may be holding some businesses back from buying cyber cover right now, but as economies return to growth, the cyber line looks set to receive strong demand going forward,” Hatton concluded.