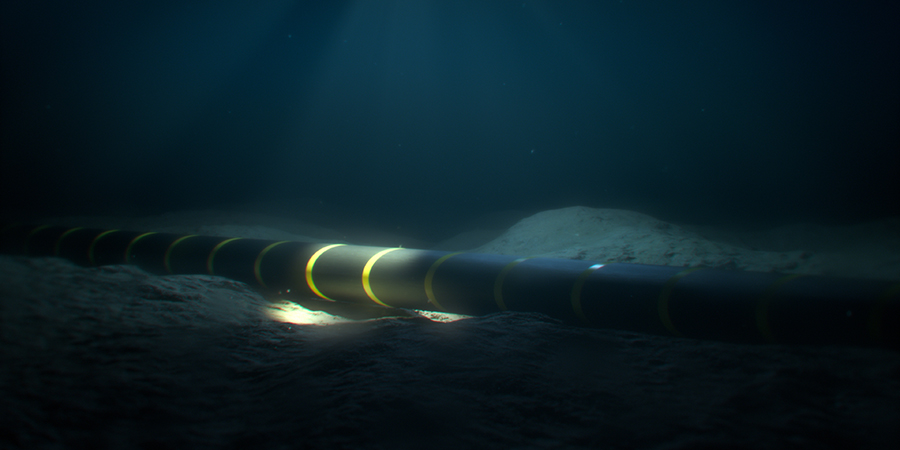

Submarine cables are the unsung heroes of the digital age, forming a vast network beneath the world's oceans that facilitates global communication and commerce. While the physical infrastructure of these cables is paramount, true resilience extends beyond mere hardware; it encompasses a strategic blend of supplier diversity, route diversification, and tailored resilience strategies that vary across countries and regions.

The Threat Landscape Necessitating Submarine Cable Resilience

Recent disruptions have underscored the critical role of submarine cables in sustaining international data flows. As digital demand surges, particularly in Southeast Asia, submarine cables are becoming increasingly pivotal in linking data centers worldwide.

The eruption of the Hunga Tonga–Hunga Haʻapai volcano in January, 2022, led to significant damage to the Tonga Cable System, located in the Pacific Ocean, severing primary internet connections. In November, 2022, the SEA-ME-WE-5 submarine cable was severed in Egypt, causing internet disruptions across Asia and Africa.

Vietnam has historically faced frequent disruptions to its subsea cable infrastructure. As of June, 2024, three out of five of its international cables—the Intra Asia (IA) connection to Singapore, the Asia Pacific Gateway (APG) link, and the Asia-Africa-Europe-1 (AAE-1) pipeline—experienced outages; while in 2023, all five cables were disrupted for weeks. To improve reliability, Vietnam plans to expand its subsea cable network, adding two-to-four new cables by 2025. By 2030, Vietnam’s international subsea capacity is expected to increase from the current 62 Tbps to at least 334 Tbps.

In January, 2025, a Chinese-owned vessel severed an undersea fiber-optic cable near Taiwan. While service disruptions were minimal, the incident highlighted Taiwan's vulnerability to such threats amid ongoing geopolitical tensions.

Notably, in 2025, at least ten major cable projects spanning 10,000 to 20,000 km are expected to become operational, ensuring greater bandwidth and reliability.

The Imperative of Supplier Diversity

Relying on a single supplier for submarine cable infrastructure can lead to vulnerabilities, including supply chain disruptions, technological stagnation, and geopolitical risks. Diversifying suppliers mitigates these risks by fostering competition, encouraging innovation, and reducing dependency on any single entity.

For instance, India's increasing dependence on submarine cables for internet connectivity has necessitated a comprehensive strategy to bolster its digital resilience. Currently, India relies on foreign-flagged vessels for repairing submarine cables within its Exclusive Economic Zone (EEZ), leading to prolonged repair timelines and heightened vulnerabilities. Establishing an Indian-flagged cable repair vessel will mitigate the risks posed by foreign intervention, supply chain constraints, and geopolitical instability. These disruptions, whether caused by natural disasters, accidental damage, or sabotage, can significantly impact financial markets, communication networks, and overall national security.

Similarly, Sun Cable, an Australian company, is spearheading the Australia-Asia PowerLink project, which aims to transmit solar-generated electricity from a vast solar farm in Australia's Northern Territory to Singapore. The project involves constructing a 4,300-kilometer subsea high-voltage direct current (HVDC) cable, designed to supply approximately 6 gigawatts (GW) of electricity, meeting about 15% of Singapore's energy needs. In October, 2024, Singapore's Energy Market Authority granted conditional approval, recognizing the project's technical and commercial viability. The project is anticipated to be fully operational by 2035.

One of APAC’s latest projects, the SEA Hainan-Hong Kong Express (SEA-H2X) cable system, is a 5,000-kilometer-long submarine optical cable that aims to strengthen digital infrastructure across Southeast Asia. The SEA-H2X project is a collaborative effort among multiple international telecommunications companies, including Converge ICT Solutions, China Mobile International Limited, China Unicom Global, and PPTEL.

Dennis Uy, CEO and Co-Founder of Converge ICT Solutions, emphasized the importance of supplier diversity in subsea cable projects.

“This SEA-H2X submarine cable system will boost the connectivity between our two points of presence (PoP) located in Hong Kong and in Singapore. Further, this will serve as a crucial infrastructure to add diversity and redundancy to our international network.”

Interesting Read: Anup Gupta on APTelecom’s Subsea Innovations and Tackling Digital Security

Navigating Geopolitical Complexities

Tensions in the South China Sea among Brunei, China, Malaysia, the Philippines, Taiwan, and Vietnam, coupled with external geopolitical rivalries, have disrupted submarine cable projects. China’s territorial claims have delayed initiatives like SJC 2 (the Southeast Asia–Japan 2 submarine cable system), with Beijing stalling permits and even demanding reroutes before consortiums submit applications.

Speculation suggests these actions are retaliatory responses to US policies, as Washington’s de-risking from China reshapes global tech infrastructure. With its ‘Made in China 2025’ strategy, China aims to control 60% of the global fiber-optic market, and five of the world’s seven major fiber-optic cable firms—including Huawei, ZTE, and China Telecom—are Chinese.

The geographical paths that submarine cables traverse are as crucial as the cables themselves. Concentrating cables along specific routes can expose networks to natural disasters, geopolitical tensions, and other localized risks. Diversifying routes ensures that if one pathway is compromised, alternative routes can maintain uninterrupted connectivity.

A pertinent example is the South China Sea, a region through which a significant portion of submarine cables connecting Asia and the Americas pass. Given the area's geopolitical volatility, businesses are increasingly recognizing the importance of diversifying their subsea cable routes. In 2023, the risks of over-reliance on the South China Sea for data traffic became too great to ignore. Global stakeholders responded by developing alternative routes to bypass the region and reduce exposure to geopolitical risks.

One of the first significant steps was the launch of the Bifrost Cable in 2024, backed by Meta, which connects Singapore and the Philippines directly to the U.S. via Indonesia, offering a safer alternative route. Shortly after, Google and Meta collaborated on the Echo cable, a project designed to provide a direct Singapore–Indonesia–U.S. link, strengthening redundancy, according to Google Cloud. Similarly, the Apricot Cable, launched in 2024, created another Japan-to-Singapore connection via the east side of the Philippines, further reducing reliance on the South China Sea, as reported by NEC. Looking ahead, the Hawaiki Nui cable, set for completion in 2026, will strengthen connectivity between Southeast Asia, Australia, and the U.S. through a Pacific-focused route.

Tailored Resilience Strategies

In 2025, diversification efforts will go beyond routes and suppliers; businesses and governments are also investing in new maintenance and contingency strategies to prepare for potential disruptions. AI-powered analytics are being integrated into network monitoring systems to predict and mitigate potential failures before they occur.

Analysts at Digital Realty suggest that to achieve high connectivity and availability standards, such as “Five Nines” (99.999% uptime), it’s essential to utilize at least four diverse cables on most APAC routes. This approach ensures that if one cable encounters issues, others can maintain the connectivity, thereby enhancing overall network resilience.

The adoption of spectrum sharing services on open submarine cables is also gaining traction in the APAC region. This model allows multiple operators to share the same cable infrastructure, promoting supplier diversity and optimizing costs.

Related: Kenji Takemura Discusses NEC’s Role in Enabling Future-Ready Connectivity

The future of subsea cable maintenance will increasingly rely on tailored strategies that leverage diverse suppliers, redundant routes, and advanced monitoring technologies to mitigate risks and maintain seamless global communication.

More Subsea Cable Reads:

The Asia Direct Cable System and Its Role in Shaping the Region’s Digital Future

Globe Chosen as Partner for Malaysia-U.S. Submarine Cable Project

APTelecom Leads in Converged Connectivity and Subsea Cable-Driven Digital Infrastructure Development

Website block quote