In an exclusive three-part series, Telecom Review will share valuable insights on the benchmarking of leading telecom vendors’ carrier and enterprise business operations.

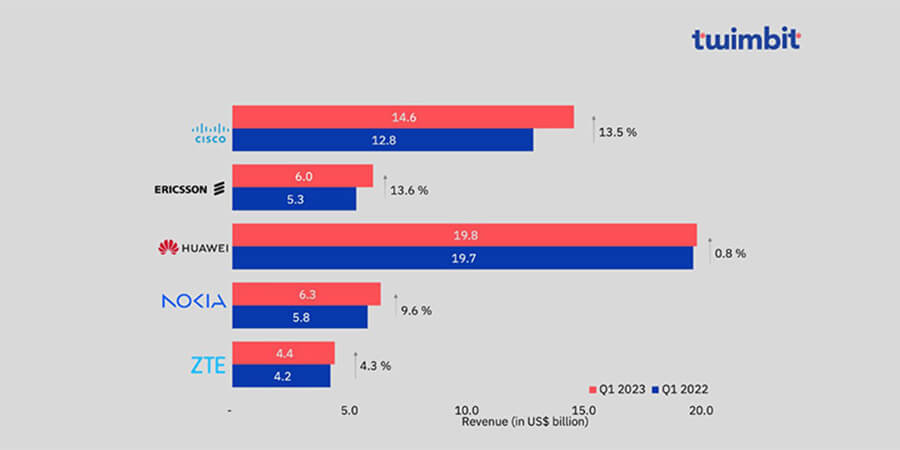

For the first leg, we will look into their financial performance. According to a Twimbit analysis titled "Q1 2023 Telecom Equipment Vendor Performance Benchmarks," the top five global telecom vendors — Cisco, Ericsson, Huawei, Nokia and ZTE — saw a remarkable surge in revenue during the first quarter of the year, showcasing a collective year-on-year (YoY) growth rate of 6.6%.

Twimbit noted that Chinese equipment vendors, Huawei and ZTE, do not disclose quarterly revenue for specific segments or geographic regions.

Let's delve into the revenue growth performance of these vendors during Q1 2023:

- Cisco and Ericsson both experienced impressive double-digit growth in their businesses, with growth rates of 13.5% and 13.6%, respectively.

- Nokia also achieved substantial growth, with a growth rate of 9.6%.

- Chinese vendors Huawei and ZTE witnessed growth as well, although at slightly lower rates, with YoY growth rates of 0.8% and 4.3%, respectively, including their consumer business revenue.

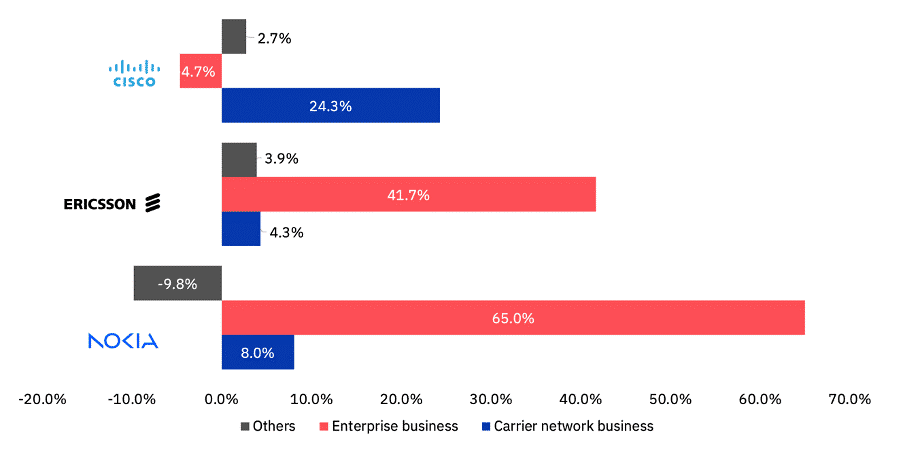

Ericsson and Nokia experienced robust growth in their enterprise business, driven by the increasing demand for 5G deployment. However, Cisco relied on its carrier network business as a key revenue driver in Q1 2023, while its enterprise business witnessed a decline.

Revenue growth percentage by customer type

Source: twimbit analysis

Cisco

Cisco's total revenue soared by 13.5% to reach $14.6 billion, with a remarkable increase in product revenue of 17% and a steady increase in service revenue of 2.7%. Cisco's carrier network business achieved a significant growth rate of 24.3%, primarily fueled by strong product revenue. Notably, the Secure, Agile Networks segment witnessed a growth of 28.6%, while the Internet for the Future segment increased by 5.1%.

Related: New Cloud Tools From Cisco for Networking, Security and Operations

Ericsson

Ericsson's earnings reached US$6 billion, including US$0.3 billion from Vonage, marking a 14% increase. Due to the network's business restructuring, the IoT business was shifted from the enterprise to other segments, resulting in a gross profit margin decline to 39.8% in Q1 2023. Enterprise Wireless Solutions and Vonage consolidation contributed to an increase in operating expenses.

Related: Ericsson Q1 2023: Net Sales Boost Driven by Enterprise

While Southeast Asia and India fueled a 4% rise in network sales, other markets experienced a slight decline. Network sales dropped by 600 basis points to 68% in Q1 2023. However, enterprise organic sales, excluding Vonage, experienced a substantial gain of 19%. Including Vonage revenue, enterprise revenue witnessed a staggering 41.7% YoY growth. Cloud software and services recorded an 11% increase in Q1 2023, but future quarters are expected to demonstrate slightly less growth.

Related: Ericsson Strengthens Cloud Software and Services Segment in 2023

Huawei

Huawei generated revenue of US$19.8 billion, reflecting a modest YoY increase of 0.8% with a net profit margin of 2.2%. The overall business results aligned with projections. Huawei increased its R&D spending to continue innovating for the future, create new value for customers, partners and global communities, and promote quality development.

Related: Huawei Sees Annual Profit Slump Amid Heavy R&D Investment

Nokia

Nokia reported a significant increase of 9%, with growth across all business groups except Nokia Technologies. The gross profit margin experienced a decline of 310 basis points, settling at 37.5% from 40.6%. Network infrastructure witnessed a solid 14% YoY growth, with IP networks expanding by 13% and optical networks by an impressive 45%. However, fixed networks declined by 5%, offsetting some of the overall rise. Normalized supply chains played a crucial role in driving growth in Q1 2023, but future quarters might pose greater challenges for comparisons.

Related: Nokia Reports Strong Net Sales Growth in Q1 2023

Nokia's order book propelled a remarkable 65% YoY growth in enterprise revenue. In Q1 2023, Nokia acquired 73 new enterprise clients, bringing the total to over 595 customers. However, Nokia Technologies' revenue witnessed a 21% decline due to a long-term license that was exercised in Q4 2022 and no longer contributes to licensing revenue.

Related: Nokia Forges Ahead as a B2B Technology Innovation Leader

ZTE

ZTE reported strong financial results for the first quarter of 2023, with revenues reaching $24.3 billion, reflecting a YoY increase of 4.3%. ZTE's net profit witnessed an impressive growth of 19.2%. These financial results highlight ZTE's resilience and adaptability in the face of ongoing global challenges. The company's methodical and pragmatic approach to business operations has contributed to its impressive growth, further solidifying its position as a global leader in the ICT industry.